- (un)ordinary recruiter

- Posts

- 5.Setting Up Shop

5.Setting Up Shop

Reduce taxable income while reinvesting in your business

Personal Thoughts: Taxes are a good thing, it means you’re making money. Turn taxes into a great thing - now you’re doing business.

In this email 👇

Necessities. Three tools to rule them all

Tax Game. Play the game

Entity Structure. Must do’s for any business

🎁 BONUS. Split-fee agreement

Good news! Starting your recruiting business requires very little overhead.

You don’t need inventory, parts, or even an office.

The only 3 tools you actually need are:

💻 Computer: The heart of your operation. Whether you're crafting compelling messages, finding candidates, or simply tracking your finances, your computer is your command center.

📩 Email: You’ll need an email to communicate important information and documents with candidates and prospects alike.

📲 Phone: Unless you plan to speak to no one, you’re going to need a phone.

P.S. If you plan to speak to no one, you’re in the wrong business.

Tax Game

Turning Tax Planning from Tedious to Tactical

Taxes, often viewed as a necessary evil, can actually be a strategic benefit in which you can thrive.

Here’s a few examples of why 👇

Example 1: Deducting Business Expenses You've made $100,000. Ordinarily, a chunk goes to taxes (~30%), but you've smartly invested $13,000 back into the business—new equipment, virtual assistant, marketing, etc.

This lowers your taxable income to $87,000, effectively reducing your tax bill by reinvesting into your business.

Example 2: Claiming the Home Office Deduction Many entrepreneurs start their recruiting business from home. If you use a portion of your home regularly and exclusively for business, you qualify for the home office deduction.

This can include a percentage of your mortgage interest, insurance, utilities, repairs, and depreciation. This deduction lowers your taxable income by allowing you to allocate a portion of household expenses to your business.

In conclusion: We all pay taxes.

Paying taxes is a good thing, it means you’re making money 💰

What you need to figure out how to use those tax dollars for business growth, instead of sending a large check to uncle Sam at the end of the year.

Then you’re (really) playing the game 😎

Legal Foundation

To legally operate any business, certain legal requirements need to be met.

This might seem daunting, but the importance of entity setup cannot be ignored.

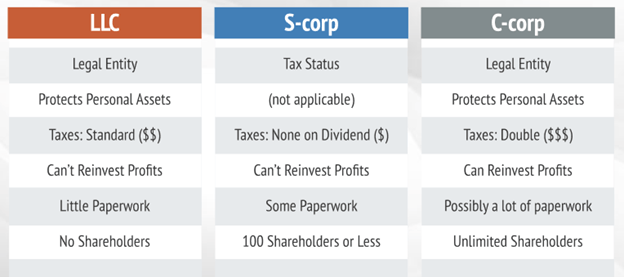

Business Structure: Choosing the right entity (LLC, S Corp, etc.) directly impacts your taxes, liability, and operational flexibility.

This is not a one size fits all solution and will require some planning to determine which structure is right for you.

Here’s a video to help you out:

Contracts and Agreements: This is the DNA of any business relationship.

Creating clear, well-drafted agreements protect your interests, clarify obligations, and sets the framework for future business.

Here two agreements I’d recommend having on hand:

NDA / Non-solicitation: Ensures your protecting your businesses’ intellectual property by protecting secretes, clients and operations unique to your business.

Professional Service Agreement: A contractual agreement between both parties to do business together and the terms both parties will follow.

🎁 Looking to do split fees? Here’s a one-page document to get you started.

Regulatory Compliance: Compliance is non-negotiable. It safeguards your business against legal pitfalls and ensures smooth sailing.

EIN: This is your tax identification number for your business, similar to a social security number for a person.

W9: Verifies your business entities name, address, and tax identification number of your business, and is required by the IRS to earn income in 🇺🇸

Without these two documents, you cannot do business.

Earn free gifts 🎁

You can get free stuff for referring friends & family to the newsletter

👇

500 referrals - 1 Year of LinkedIn Recruiter (on me) 🏦

10 referrals - Beta access to our candidate scorecard software 💻

5 referrals - Access to the #1 recruiter community on the planet 🌎️

2 referrals - 100 of the top recruiter tools on the internet 🔥

1 referral - Get a LinkedIn Endorsement! 🚀

You currently have 0 referrals, only 1 away from receiving a LinkedIn Endorsement!.

Copy & paste this link: https://unordinaryrecruiter.beehiiv.com/subscribe?ref=PLACEHOLDER

Plus it really helps me out 😇

Last but not least…

Get yourself a bank account and accounting software.

👉 We use Quickbooks for our accounting software to invoice, track and categorize our business expenses.

👉 Setting up a bank account is important not only to deposit funds for the work you’ve done, but also separate business from personal expenses which will save you 50+ hours / year.

What’s Next…

👉 What to do immediately after quitting your corporate job to pursue staffing immortality 🚀

If you enjoyed this newsletter, please share with a friend - it helps me out, and you earn COOL rewards too! 🫶

See you next week, friends!